7 Common Mistakes Beginner and Prop Firm Traders Must Avoid

Trading can be an exciting yet challenging journey, especially for beginners and those attempting proprietary firm (prop firm) challenges. The statistics are bleak – a significant majority of new traders fail, not due to a lack of effort or intelligence, but often because of avoidable mistakes. By understanding and sidestepping these common pitfalls, you can greatly improve your chances of long-term success.

Below, we break down seven critical mistakes that beginner traders (and prop firm traders) should avoid, along with tips on how to do things the right way.

1. Trading Without a Plan

One of the fastest ways to fail as a trader is to jump in without a clear, structured trading plan. A beginner should never enter the market without a plan – trading without one is like a ship sailing without a compass, leaving you vulnerable to the market’s unpredictability. Unfortunately, many new traders dive in on a whim or based on random tips, only to find themselves reacting emotionally rather than following any logic or strategy. In the context of prop firm challenges, buying an evaluation account without knowing what you will trade, when you will trade, and how you will trade is a recipe for disaster.

Create a detailed trading plan before placing any real trade. Your plan should define your trading strategy – including what instruments you will trade, your entry and exit rules, risk management protocols, and profit targets. Test this plan on a demo account first to make sure it works under various market conditions. Most importantly, once you launch your plan, stick to it with discipline. As the saying goes, “plan the trade and trade the plan.” A well-defined plan will keep you focused and prevent impulsive, emotion-driven decisions. Remember that a solid plan turns trading from gambling into a repeatable process.

2. Ignoring Risk Management

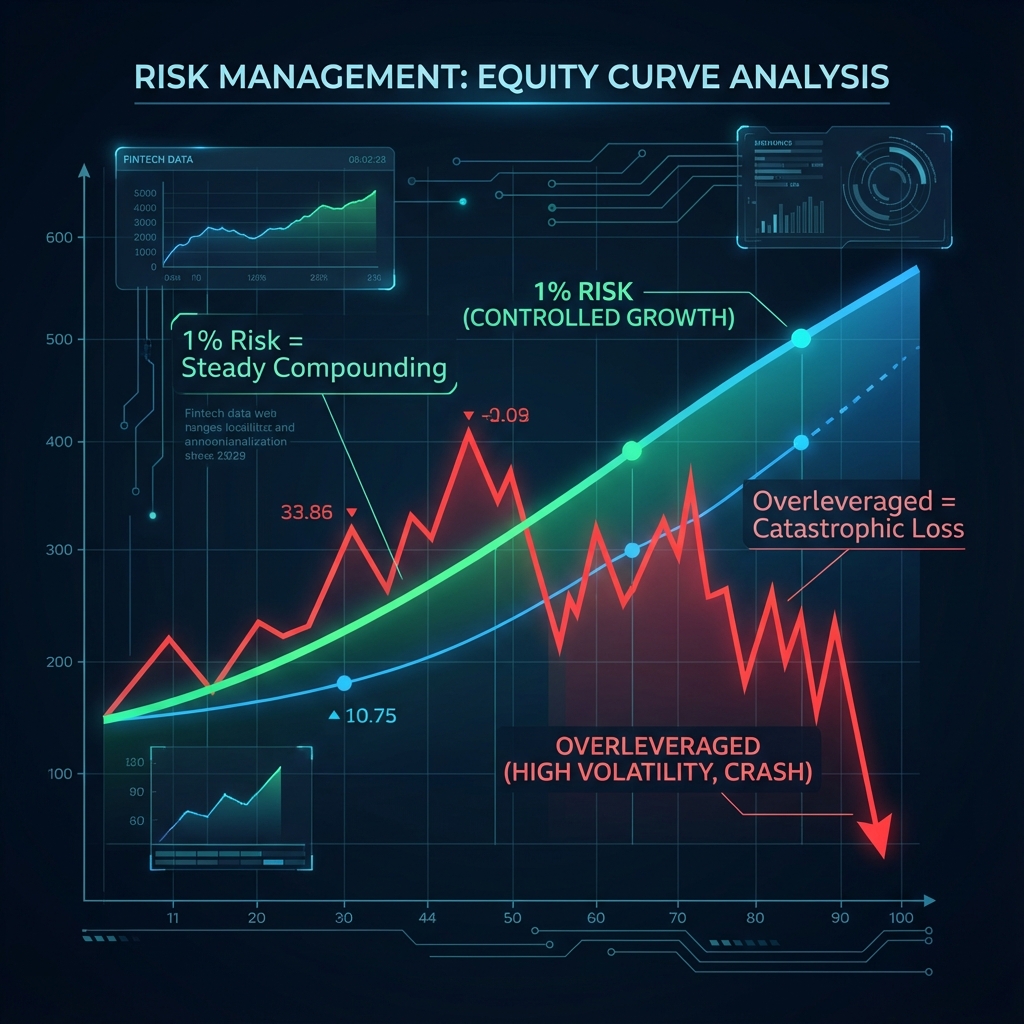

New traders often fixate on potential profits and neglect the risks that come with each trade. Ignoring risk management is a critical mistake that can end a trading career before it even gets off the ground. Many beginners risk far too much of their capital on a single position, hoping for a big win. The danger is that just a couple of large losing trades can wipe out your account entirely. In fact, the first rule of trading is preservation of capital – your survival depends on managing risk even more than on finding winning trades. This principle is even more vital for prop firm traders: for example, a $100,000 prop firm evaluation account might have a 10% maximum drawdown (meaning you can’t lose more than $10,000). If you risk 2% of the account ($2,000) on each trade, just five losing trades in a row could blow the entire evaluation. Without proper risk controls, even a great strategy can implode from a string of losses.

In the chart above, the green and red zones illustrate a trade setup with a predefined stop-loss (green area) and take-profit (red area). Setting clear stop-loss and take-profit levels is a key risk management practice that protects your account from excessive losses and locks in gains. New traders who skip this step often suffer large drawdowns when trades move against them without an exit plan. Using stop-loss orders enforces discipline and keeps losses manageable, preventing small setbacks from turning into account-threatening damage.

Always manage your risk per trade. A widely cited “golden rule” is to risk no more than 1-2% of your trading capital on any single trade. This ensures that a streak of losses won’t decimate your account – you’ll live to trade another day. Set a stop-loss on every trade to cap your downside, and use appropriate position sizing so that the dollar amount at risk stays within that 1-2% range. For prop firm challenges, be acutely aware of the firm’s loss limits (e.g. daily drawdown and total drawdown limits) and plan your trade size accordingly. Professional traders typically risk only about 0.5% (or even less) of the account per trade when doing prop evaluations, trading small and controlled until consistent profitability is shown. By respecting risk management, you shift focus from “how much can I win?” to “how much can I lose?” – which is the mindset that keeps you in the game for the long run.

3. Unrealistic Expectations (Chasing Quick Profits)

Many beginners enter trading with unrealistic expectations, hoping to get rich quick. The lure of quick profits can lead to overly ambitious goals – like trying to double an account in a month or expecting every day to be hugely profitable. This mindset is dangerous: traders who focus on rapid gains often end up taking excessive risks, overleveraging, and abandoning sound strategy in the pursuit of fast money. In fact, a study shows that 90% of day traders who chase unrealistic returns end up losing money in their first year. In the prop firm world, this might manifest as trying to pass a challenge in just a few trades by betting big, rather than trading steadily within the rules. Unrealistic expectations create pressure to overtrade and ignore risk (mistakes we’ve already noted), setting traders up for failure.

Set realistic, sustainable goals for your trading. Understand that trading is not a “get rich quick” scheme – it’s a skill that requires practice, patience, and realistic goal-setting. Instead of aiming to strike gold overnight, focus on consistent process and incremental growth. For example, a reasonable goal for a new trader might be to protect capital and achieve a modest monthly return (or even just break even) while you learn. If you’re in a prop firm evaluation, aim to pass by following all rules and steadily reaching the profit target, not by gambling on one huge win. Keep in mind that steady progress – even just a few percent gain a month – can compound significantly over time. By replacing unrealistic expectations with disciplined process, you avoid the trap of taking wild risks. As one guide puts it, trading success comes from steady, calculated progress rather than dramatic gains. Be patient with yourself and the market; over time, consistent modest wins and controlled losses will take you much further than any lucky jackpot trade.

4. Letting Emotions Drive Decisions

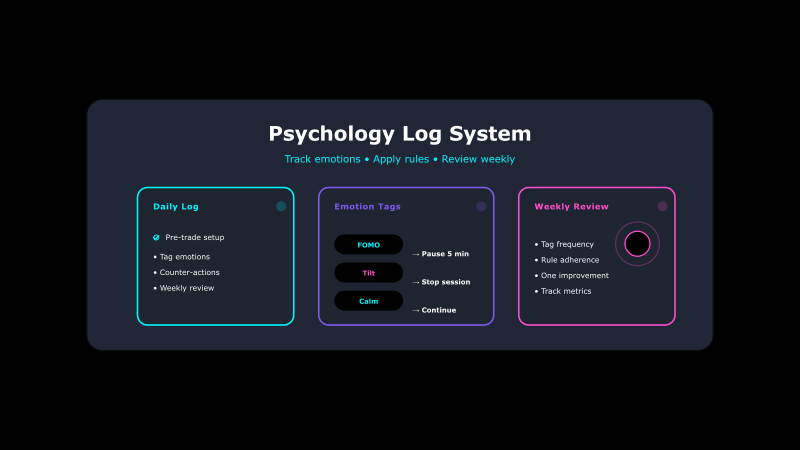

Trading is as much a mental game as it is a numbers game. Two of the most dangerous emotions for a trader are greed and fear – and letting these emotions drive your decisions is a sure recipe for trouble. Greed can cause you to hold onto winning trades too long or risk too much in the hopes of bigger profits, often turning a winner into a loser. Fear can cause you to exit trades too early (cutting your winners short) or to avoid taking good trades at all, as well as abandon your trading plan at the first sign of trouble. In short, emotional trading leads to inconsistent and poor decisions: you might move your stop-loss farther down once a trade goes in the red, simply hoping the price will turn around, or you might close a profitable trade prematurely just to “lock something in” because you’re afraid of losing the profit. These fear/greed-driven actions violate your plan and risk management rules, usually with painful results.

Develop emotional discipline as part of your trading routine. First, acknowledge that feelings like excitement, fear, or frustration are natural – but your actions must remain disciplined regardless. Stick to your predefined stop-loss and take-profit levels and resist the urge to tinker with trades based on gut feelings. If you find yourself feeling overly anxious or greedy, take a step back. Some traders find it helpful to set strict rules like “if I have two losing trades in a row, I will take a break” to prevent emotional meltdowns. Others practice mindfulness or have a routine (e.g. journaling trades and emotions, or doing a quick meditation) to stay calm and focused. The key is to trust your system and your plan. By following a plan rather than your feelings, you ensure consistency. Remember, even a profitable strategy can be ruined by emotional decision-making. As prop firm traders often learn, the psychological pressure in an evaluation can be intense – but those who succeed are the ones who internalize discipline and keep a level head under stress. Make logic, not emotion, the driver of your trades.

5. Overtrading (Too Many Trades, Too Often)

When starting out, many traders feel like they must always be doing something in the market. This leads to overtrading – taking far too many trades, often on low-quality setups, just to feel active. Beginners sometimes believe frequent trading will give them more opportunities to profit, but the opposite is usually true. Overtrading often results in subpar trades that deviate from your strategy and racks up unnecessary transaction fees (commissions and spreads), which eat into any gains. You may also find yourself trading out of boredom or a misguided sense that you should “make back” what you lost earlier in the day, entering positions when no clear signal is present. The need to trade every day (or all day) can become overwhelming – even when your strategy isn’t actually giving any valid entry signals. This is especially dangerous after you’ve had some losses: feeling the urge to immediately win it back can push you into a cycle of revenge trading (which we’ll discuss next) and over-leveraging. In prop firm challenges, overtrading can be a quick path to violating the consistency rules or hitting loss limits, because taking many trades increases the chance of mistakes.

Quality over quantity is the mantra of successful traders. Recognize that sometimes the best action is no trade at all. Patience is a virtue in trading – wait for high-probability setups that meet your strategy criteria, rather than forcing trades in choppy or unclear markets. It’s far better to take a few well-thought-out trades than dozens of impulsive ones. Create rules in your plan to prevent overtrading, such as a maximum number of trades per day or week, or only trading during certain high-probability time windows. Keep a trading journal and review it: if you notice you took a trade out of boredom or FOMO (fear of missing out), learn from that and adjust. In prop trading, understand that doing nothing is perfectly acceptable if conditions aren’t right – prop firms are looking for consistency and discipline, not constant action. As one prop firm advises, “there are situations where the most advantageous choice is making no trade at all… Quality of trades always trumps quantity”. By trading less but with more intention, you’ll likely see better results and preserve both your capital and mental capital.

6. Chasing Losses (Revenge Trading)

Nearly every trader experiences losing trades – that’s part of the game. The mistake comes when a beginner cannot accept a loss and immediately tries to chase it to get the money back. This impulse leads to what’s known as revenge trading. For example, say you just closed a trade for a loss; feeling upset, you double your position size on the next trade or jump into a random setup in hopes of quickly recovering what you lost. This is a dangerous spiral: a trader desperate to recover losses will often abandon their strategy and take on much higher risk, leading to even bigger losses and a worsened financial (and emotional) situation. Chasing losses is essentially letting frustration and fear of losing control your actions. In prop firm challenges, revenge trading can be fatal – one or two over-leveraged “make back the loss” trades can instantly push you past the drawdown limits, ending the challenge. It’s no surprise that revenge trading is cited as one of the fastest ways to blow up an account or fail a challenge.

Accept that losses are a normal part of trading. Even the best strategies will have losing streaks. The key is to keep those losses small and stick to your plan. When you hit a loss, fight the urge to immediately “win it back.” Instead, consider taking a short break – step away from the screen to clear your head. Use that time to review the losing trade objectively: Did it follow your trading plan and just happen to lose (which is fine), or was it a mistake to begin with? If it followed your plan, remind yourself that a good trade can have a bad outcome and that’s okay. If it didn’t, identify what went wrong so you learn from it. Only return to trading when you are calm and refocused on following your strategy, not on making back money. Some traders implement rules like a “daily stop” – for instance, if they lose a certain amount in one day, they stop trading for that day to prevent emotional spirals. By approaching losses with a cool head and a learning mindset, you prevent one loss from snowballing into many. Remember, as the saying goes, “cut your losses short” – not by chasing them, but by sticking to your planned risk limits and moving on to the next good opportunity when it comes. Trading is a marathon, not a sprint, and handling losses gracefully is what keeps you in the race.

7. Not Understanding or Following Prop Firm Rules

This mistake is specifically relevant for traders in prop firm evaluations. Proprietary trading firms each have their own set of rules – daily loss limits, maximum drawdowns, profit targets, minimum trading days, news trading restrictions, consistency rules, and more. A common error is jumping into a prop firm challenge without fully understanding the firm’s rules and requirements. Many traders have unfortunately blown an evaluation not because their trades were all bad, but because they unknowingly violated a rule – for example, hitting a trailing drawdown by a tiny margin or trading when they weren’t allowed to. Every prop firm’s terms differ slightly, so what is acceptable at one firm could fail you at another. Ignorance is no excuse: firms will not bend the rules for you. If you break a rule, even by accident, your account can be terminated immediately – no refunds, no do-overs. Some commonly overlooked rules include how the maximum and daily drawdowns are calculated (e.g. some firms calculate drawdown from the starting balance, others from the highest balance achieved – which means your profit can raise the bar for what counts as a loss), restrictions on trading around major news releases, holding trades over weekends, or requirements to use stop-loss orders. For instance, certain firms require you to place a stop-loss on every trade and will consider your account breached if you don’t. Failing to read and follow these rules can lead to a swift disqualification even if you were trading profitably.

Do your homework before you start any prop firm challenge. Carefully read through the firm’s rulebook or FAQ and make sure you understand all the key parameters. Pay special attention to: daily loss limit, total max loss (drawdown) limit, profit target, minimum trading days, prohibited trading times (like news events or weekends), any consistency or maximum lot size rules, and required use of stop-loss or other risk controls. If anything is unclear, reach out to the firm’s support for clarification before you begin trading. It can help to write down these rules next to your trading station as a checklist. Incorporate the prop firm’s constraints into your trading plan – for example, if the daily drawdown limit is 5%, you might set a personal rule to stop trading for the day if you’re down 2% or 3%, to stay well within the limit. Treat the evaluation like a professional would: it’s not just about making profits, it’s about showing you can adhere to a structured risk management framework. Ultimately, knowing the “structure you’re operating in” is part of trading wisely. By following every rule to the letter, you not only avoid inadvertent disqualifications but also demonstrate the discipline that prop firms value in funded traders.

Conclusion

The journey to becoming a successful trader – whether on your own or with a prop firm – is a marathon, not a sprint. The common mistakes we’ve discussed (lack of a plan, poor risk management, unrealistic expectations, emotional trading, overtrading, revenge trading, and not following rules) all stem from insufficient preparation and weak self-discipline, coupled with the inability to manage emotions under stress. The encouraging news is that all of these mistakes are avoidable with the right mindset and practices. By developing a solid trading plan, enforcing strict risk management, keeping your expectations realistic, and cultivating discipline (through habits like journaling and self-review), you set yourself up to navigate the markets successfully. Remember that your primary objective as a beginner is to preserve your capital and learn – profits will follow as your skill and experience grow. Every successful trader has made mistakes along the way; what separates those who succeed is their commitment to learning from those mistakes and never repeating them. If you focus on building good trading habits and avoiding the pitfalls above, you’ll greatly increase your chances of long-term success in trading. Stay disciplined, keep learning, and trade safe!