7 Common Mistakes Beginner Prop Firm Traders Should Avoid

Beginner traders – especially those attempting proprietary trading firm (prop firm) challenges – often face steep learning curves. Prop firms provide traders with access to substantial trading capital (ranging from about $5,000 to $500,000) in exchange for a share of the profits. This opportunity is enticing, but the reality is that most traders fail prop firm challenges, usually due to avoidable errors. To improve your odds of success, it’s crucial to be aware of these pitfalls early.

Below we outline seven common mistakes that new prop firm traders make, along with tips on how to avoid them, so you can trade more confidently and boost your chances of passing evaluations.

1. Trading Without a Clear Plan

Diving into trading without a well-defined plan is a recipe for disaster. Impulse trading – entering or exiting positions based on gut feelings, hot tips, or emotions – often leads to inconsistency and big losses. Your trading plan is essentially your roadmap; without it, you’re handing control over to the market and your own emotions. A solid plan should define your strategy, the setups you look for, entry/exit rules, and risk management guidelines. Skipping this homework means you’ll likely make ad-hoc decisions, overtrade, or chase random trades that don’t fit a proven strategy. In prop firm challenges (which have strict rules and time limits), a lack of planning almost guarantees failure.

Take time to formulate a detailed trading plan before you trade funded capital. Outline what instruments you will trade, what your ideal trade setups look like, how you will manage risk (stop-loss, position sizing), and under what conditions you will stay out of the market. Practice on a demo account to test and refine this plan until you have consistent results. Treat the demo seriously – as if real money is on the line – so that when you switch to a prop firm evaluation, you’ll execute your plan with discipline and confidence. Remember, never trade blindly. A plan won’t guarantee profits, but it will impose the discipline needed to avoid impulsive mistakes.

2. Not Understanding Prop Firm Rules

Prop firms impose specific rules and trading objectives that you must follow, and not fully understanding them is a common beginner mistake. Each firm’s evaluation can have different parameters, so read the fine print before you place your first trade. Many new traders jump into a challenge account only to realize (too late) that they violated a rule they overlooked – which can mean instant disqualification. Key rules to be aware of often include:

- Daily and Maximum Drawdown Limits: Prop firms cap how much you can lose. Some calculate drawdown based on your starting balance, others use equity, and some use a trailing drawdown that moves up as you profit. Exceeding the daily loss or total loss limit (even by a small amount) will fail your challenge, so you must know these thresholds at all times.

- News Trading Restrictions: Certain firms prohibit trading during high-impact news events (for example, not opening or closing trades within a few minutes around major economic releases). Ignoring such restrictions could lead to having profits disqualified or an outright breach of your account.

- Profit Consistency Rules: Some evaluations require that your profits be made over several days rather than in one lucky trade. These consistency rules prevent funded traders from, say, passing a challenge with one huge win and then struggling afterward. If you make most of your profit in one day or one trade, you might be asked to continue trading to show consistency, or worse, you could violate the terms and lose the account.

- Risk and Stop-Loss Requirements: To curb reckless behavior, many prop firms limit how much you can risk per trade (often around 1% of the account) and even mandate using stop-loss orders on every position. For instance, some firms will automatically fail you if you trade without a stop-loss in place. Failing to understand these risk rules – like maximum allowed lot size or the necessity of stops – can quickly get your account flagged or terminated.

Always thoroughly review the prop firm’s rule book and objectives. Know your exact daily loss limit and overall drawdown, any timing restrictions (don’t hold trades overnight or over weekends if they forbid it), and the profit target you need to hit within the given time. Being crystal clear on the rules will help you strategize properly and avoid unwitting violations. In short: treat the evaluation like an exam – study the rules page until nothing surprises you.

3. Poor Risk Management and Overleveraging

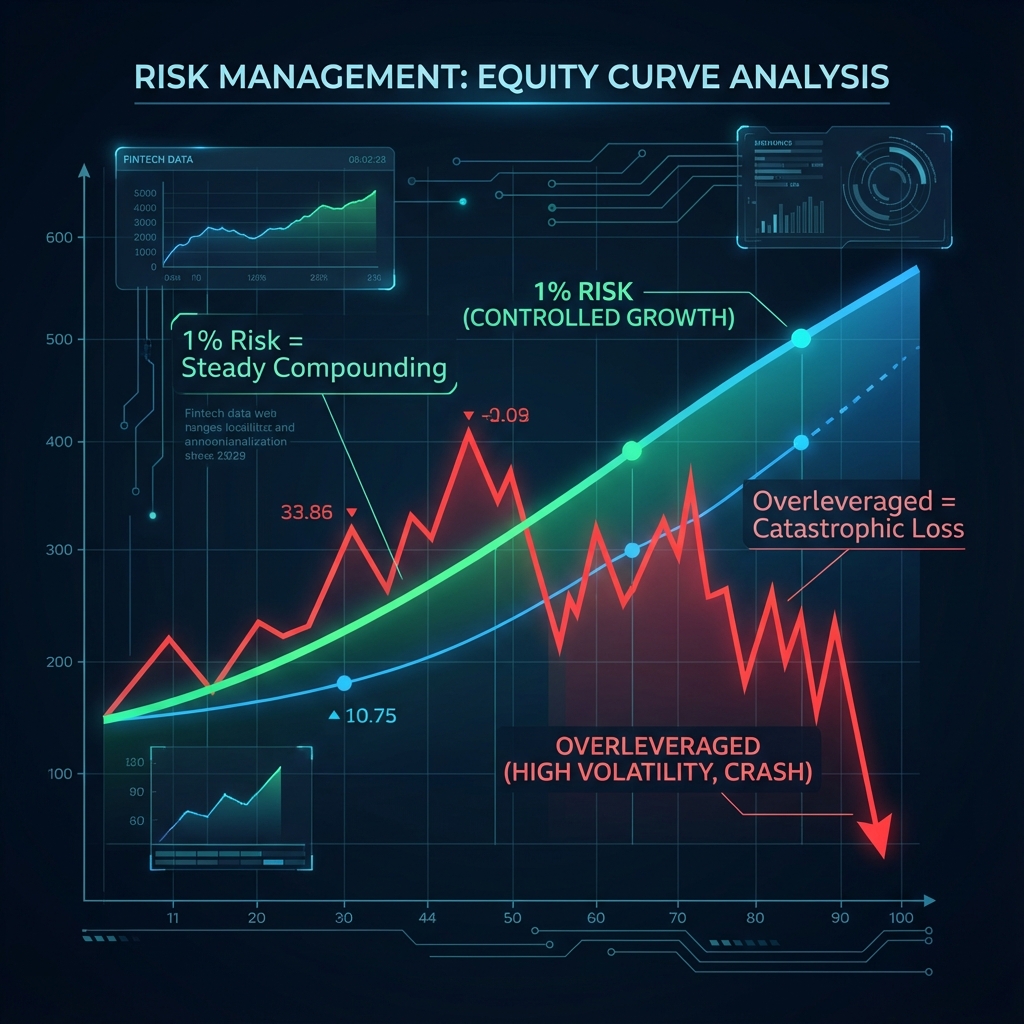

Improper risk management is perhaps the number one account killer for new traders. Many beginners either ignore risk limits or simply don’t understand how quickly losses can compound. Overleveraging – risking too large a portion of your account on one trade – can blow up an evaluation in just a few bad trades. In fact, if you have a $100,000 funded account with a 10% max drawdown (meaning you can’t lose more than $10,000), risking even 2% ($2,000) per trade means just 5 losing trades in a row would hit the limit and fail the challenge. Prop firm challenges often amplify this issue because the allowed drawdowns are much tighter than what a retail trader might tolerate in a personal account.

Another aspect of poor risk management is trading without stop-losses or widening them hoping to avoid taking a loss. Not using a stop is extremely dangerous – “hoping” a losing trade comes back is not a strategy. As one prop firm notes, a stop-loss is the ultimate form of risk control, and relying on hope or stubbornly holding a losing trade is a hallmark of amateur trading. If you don’t pre-define an exit, a single trade can spiral into a huge loss that violates your daily or overall drawdown limit.

Strictly enforce risk management rules in every trade. A good guideline (followed by many professionals) is to risk no more than 1% (or even 0.5%) of your account per trade. This ensures no single loss will be devastating. Always use a reasonable stop-loss on each position to cap your downside – and never move it farther away to “give a trade more room,” as that defeats the purpose. It’s wise to use a position size calculator to determine how many lots or shares to trade for a given stop distance, rather than trading on gut feeling. Keep in mind that prop firms are watching your risk discipline closely. If you oversize trades or show wildly inconsistent lot sizes, it flags you as a gambler rather than a serious trader. By maintaining consistent, small risk and protecting your capital, you not only survive losing streaks, but also build the trust and track record prop firms want to see for funded traders.

4. Letting Emotions Drive Your Trading (Revenge Trading & Overtrading)

Emotional decision-making in trading is a surefire way to derail your progress. Two of the most common emotional mistakes are revenge trading and overtrading. Revenge trading happens when you take a loss (or a series of losses) and immediately feel an urge to win it back. In a prop firm scenario, a trader might hit a loss and then dramatically increase their position size on the very next trade to “make back” the money – often breaking risk rules and hitting the daily loss limit in the process. This emotional response overrides logic and usually only deepens the losses. Remember: if you hit your max daily loss or a few losers in a row, stop trading for the day. Trying to get it all back at once will only compound the damage.

Overtrading is another related pitfall. This means trading excessively – taking far too many trades, often out of boredom, fear of missing out, or the compulsion to be “doing something.” Beginners may feel that if they’re not constantly in a trade, they are missing opportunities. In reality, overtrading leads to sloppy trades and high commission costs, and it dilutes the edge of your strategy. You start taking sub-par setups just to feel busy, which can quickly snowball into losses and frustration. Prop firm rules don’t typically force you to trade a high volume, so quality should always trump quantity.

The key is discipline and self-awareness. Set rules for yourself such as a “3 strikes rule” – if you have three losing trades in a day, step away from the screen (many successful traders use this to prevent a bad day from turning into a terrible day). Similarly, schedule trading hours and stick to them: if your strategy only shows 1-2 good setups a day, don’t try to manufacture more. It’s better to miss a trade than to enter a low-quality one out of impulse. Manage your mindset: accept that losses are part of the game and avoid chasing the market after a loss or chasing a runaway move you “wish” you had caught (classic FOMO). By keeping a cool head and following a consistent routine, you prevent emotional swings from dictating your trades. In prop trading, staying disciplined under pressure is exactly what the firms are looking for, so mastering your emotions is as important as mastering your strategy.

5. Skipping the Trading Journal (Not Learning from Mistakes)

Experience is the best teacher in trading – but only if you actually learn from your trades. Many beginner traders fail to maintain a trading journal or log, meaning they have no systematic record of what they did right or wrong. This is a critical mistake because memory is notoriously selective: without written records, you will forget many details of your trades or misremember them in a favorable light. A trading journal provides objective feedback on your performance, allowing you to review both your winning and losing trades with clarity. By logging each trade’s reasoning, emotion, outcome, and any rule you broke, you’ll start to notice patterns – perhaps a certain setup that consistently fails, or a bad habit of moving your stop – that you would otherwise overlook.

In the prop firm context, journaling is even more valuable. With strict targets and limits, you should analyze every challenge attempt or funded month to see what worked and what didn’t. Did a particular trading time or market give you trouble? Were most of your losses due to one type of mistake (like impulsive entries or holding losers too long)? Without a journal, you’re essentially flying blind and are likely to repeat the same errors, stalling your growth as a trader.

Start a trading journal from day one and be consistent with it. It can be a simple spreadsheet, a notebook, or a specialized journaling app – whatever makes it easy for you to log details like date/time, instrument, entry & exit, why you took the trade, outcome, and your emotions or thoughts. After a series of trades, review your journal to identify recurring issues or strengths. For example, you might discover that you do well on trend-following trades but lose when you try to countertrend, or that most of your big losses came when you deviated from your plan. These insights are gold. Over time, your journal becomes a personalized guide to continual improvement, spotlighting which behaviors to reinforce and which to eliminate. As the saying goes, your journal is your mirror – it shows you the truth about your trading. By not skipping this step, you’ll accelerate your learning curve and avoid making the same mistakes over and over.

6. Constantly Changing Strategies (Chasing the “Holy Grail”)

In the early stages, it’s common for new traders to jump between different strategies, indicators, or trading styles in search of the perfect system. You might try one method for a week, then abandon it after a couple of losses to experiment with another “hot” strategy you saw on YouTube or a forum. This constant strategy-hopping is often driven by the belief that somewhere out there is a flawless system that never fails – the mythical holy grail. The reality is that no strategy wins 100% of the time, and every approach will have drawdowns. As one trading veteran put it, the holy grail doesn’t exist – almost any reasonable strategy can work if executed with discipline and consistency. Conversely, even a great strategy will fail if you don’t stick to it long enough or if you keep tweaking the rules on every whim.

For prop firm traders, strategy inconsistency is particularly problematic. If you change your approach mid-challenge or keep flipping your trading plan, you never truly learn the nuances of any one method. You also can’t tell if a strategy is failing, or if it’s just normal randomness, because you didn’t give it a fair trial. This often leads to analysis paralysis or jumping into trades that don’t fit any plan at all. In short, by chasing every new idea, you end up with no edge at all.

Pick a well-defined strategy and commit to it for a reasonable period (through both good and bad streaks). Ideally, choose a strategy that matches your personality and schedule – for example, if you’re patient and analytical, a swing trading strategy might suit you; if you love fast action, maybe a scalping method (but ensure it’s allowed by your prop firm’s rules). Once you pick it, document the rules and stick to them trade after trade. Do thorough backtesting or review historical charts to gain confidence in the strategy’s long-term viability (and to know what kind of drawdown to expect). When you hit a losing streak – and you will – resist the temptation to immediately abandon the plan. Instead, review your execution: were you following the rules exactly? Was it just a normal rough patch in the market? Only consider adjustments after a significant sample size of trades. By giving a solid strategy time to play out, you build skill and consistency. Remember, disciplined execution of an imperfect plan beats haphazard execution of a perfect plan every time. As long as your strategy has an edge and you manage risk, sticking with it through the ups and downs is far more effective than continuously chasing new “secret” systems.

7. Unrealistic Expectations and Gambling Mindset

Many new traders enter prop firm challenges with unrealistic profit expectations or a get-rich-quick mindset. For example, a beginner might think they can turn a $50k funded account into $100k in a month, or feel pressured to make a certain amount of money every day. This often leads to overtrading and overleveraging as they try to force big wins. Setting a daily profit goal like “I must make $500 today” is counterproductive – if the market doesn’t offer good setups, you might take bad trades just to reach that number, which usually ends in losses. Unrealistic goals create stress and impulsive decisions, the opposite of the calm, objective mindset you need for trading.

A related pitfall is treating the prop firm evaluation like a casino. Since the entry fee for a challenge is relatively low compared to the funded capital on offer, some traders develop a gambling mindset: they take reckless bets hoping to hit the profit target in one or two lucky trades. They might risk the entire account (or a huge percentage of it) on a single trade or avoid using stops, essentially betting the farm that a trade will turn around in their favor. This approach occasionally pays off spectacularly, which can be tempting, but almost always it ends in a blown account – and even if it works once, it’s not a sustainable way to trade. Prop firms are increasingly implementing rules (like maximum risk per trade and mandatory stops) precisely to prevent this behavior, because it’s closer to gambling than professional trading.

First, set realistic expectations. Understand that successful trading is about consistency over time, not hitting home runs. Aim for steady growth and focus on executing your strategy well, rather than the dollar amount of each trade. It can help to measure success in terms of following your process – e.g. “Did I stick to my rules today?” – rather than P&L alone. Second, treat the prop firm’s capital with the same respect as if it were your own life savings. Even though the challenge fee might be small, behave as if you can’t afford to blow the account. This means no all-or-nothing bets. Stick to the risk management rules and profit slowly but surely. If you catch yourself thinking “I’ll just take a big gamble to pass fast,” step back and remember that passing is only the first step – you also need to stay funded. Traders who adopt a professional, patient approach are the ones who get funded and enjoy consistent withdrawals, whereas those swinging for the fences usually end up restarting challenges repeatedly. In summary, keep your goals reasonable and focus on the process, not just the payout. Trading is not a lottery ticket; it’s a skill-based endeavor that rewards discipline and punishes greed.

Conclusion

For beginner and prop firm traders alike, avoiding these seven mistakes can dramatically improve your trading performance and the likelihood of getting (and staying) funded. None of these concepts are rocket science – they’re basic, preventable pitfalls that even experienced traders have tripped over. The difference between those who succeed and those who continually blow up accounts often comes down to discipline, consistency, and risk control rather than any secret trading technique. By trading with a clear plan, respecting the prop firm’s rules, managing your risk diligently, and keeping your emotions in check, you put yourself in the best possible position to pass evaluations and grow your account over time. In fact, prop firms aren’t just looking for traders who can hit a profit target – they want traders who can follow rules and manage risk under pressure, proving they can protect capital. If you approach trading like a professional – focusing on process over quick profits – you’ll find that success becomes much more attainable, and you can build a sustainable trading career. Good trading!