How to Manage Emotions in Day Trading

Learning how to manage emotions in day trading is the difference between disciplined execution and tilt-fueled mistakes. Intraday swings, leverage, and rapid feedback loops magnify every feeling, so a resilient trading psychology routine must live alongside your strategy. This guide delivers a practical system: a five-step micro-pause protocol, emotion tagging framework, rule-based cooldowns, daily debrief checklist, and a downloadable 14-Day Emotion Challenge to keep your discipline measurable.

What You'll Learn

- Why emotions dominate intraday decision making and how to spot early warning signs.

- How to run a repeatable five-step micro-pause protocol whenever pressure spikes.

- How to tag, log, and counter core day trading emotions using a structured table.

- How to use the 14-Day Emotion Challenge, daily debrief template, and weekly review to build durable habits.

- Which further resources and TradeTrakR workflows help reinforce psychology tracking.

Why Emotions Dominate Intraday Decisions

Day traders operate inside a compressed feedback loop. Every candle, print, and level shifts within seconds, leaving your nervous system struggling to stay even. When you combine leverage with fast-moving risk, the brain defaults to fight-or-flight responses—impulsively grabbing subpar entries, revenge trading after losses, or freezing on valid setups. Without a process to name those spikes, physiological arousal wins.

Professional desks and elite funded traders treat emotional awareness like any other KPI. They log triggers, tally rule breaks, and review how mindset shifts affected expectancy. You do not need a psychology degree; you need structure. The protocol below packages that structure so you can recognize rising pressure, slow decisions, and return to rules before damage occurs.

The 5-Step Micro-Pause Protocol (Repeatable)

Keep this sequence within arm's reach. The goal is not to suppress emotion but to build a fast reset loop that re-centers your plan.

- Name it. Tag the emotion instantly—FOMO, fear, boredom, tilt. Naming reduces intensity.

- Breathe. Take four slow inhales and exhales away from your depth-of-market or chart.

- Re-check rules. Confirm risk per trade, daily loss limit, and allowed setups before considering the next order.

- Reduce or skip. Cut size to baseline or sit out until conditions match the plan.

- Note it. Log the emotion, trigger, and action in your journal within 30 seconds.

Run the protocol after every surge of adrenaline—not just meltdowns. Repetition makes the response automatic.

Rule-Based Cooldown Framework

Set objective triggers so you do not negotiate with yourself when adrenaline spikes. Write these prompts into your Trading Journal so compliance is trackable.

- ☐ Two rule breaks in the same hour → 20-minute cooldown away from the screen.

- ☐ -2R day or breach of max daily loss → end session and review log before next open.

- ☐ Tilt tag logged twice in a session → stop trading and schedule longer recovery work.

- ☐ External stress or fatigue indicators (headache, distractions) → run micro-pause and reduce size to half.

- ☐ Heart rate or smartwatch alert → breathe, stretch, re-evaluate if conditions still align with your edge.

Log each cooldown event in the 14-Day Emotion Challenge or your primary journal so you can audit discipline rates during weekly reviews.

The 14-Day Emotion Challenge (Download)

Consistency grows when you measure the work. The 14-Day Emotion Challenge gives you a daily structure: pre-market intention, three emotion observations, one cooldown decision, and a reflection that locks in tomorrow's rule. Print it or open it inside your journal workspace.

Pair the challenge with your micro-pause protocol. If a tag shows up three times across the 14 days, elevate the counter-action into a hard trading rule or add a pre-market reminder to address it before the opening bell.

Daily Debrief Template (Copy-Paste)

Use this five-minute closeout to connect emotions with execution quality. Drop it inside your journal or clipboard so you can paste results quickly.

- Top two emotions that influenced decisions today.

- One decision that changed after running the micro-pause protocol.

- Rule adherence summary (Y/N) and which rule broke if applicable.

- Quality of trade selection (A, B, or C setups) and why.

- One improvement rule for tomorrow's session.

Attach screenshots or order flow snippets when emotions altered execution. Visual evidence makes the pattern harder to ignore.

Weekly Review (30–45 Minutes)

Wrap the week by translating emotion data into actionable mandates so the next five sessions begin with clarity.

- Count each emotion tag by day and trading product to spot repetitive friction.

- Audit rule adherence versus rule breaks and highlight the trigger behind every violation.

- Compare expectancy, win rate, and drawdown stats on calm/focused days versus tilt or revenge days.

- Choose a single behavioral experiment for next week—e.g., "Stop trading after first revenge tag" or "Mandatory micro-pause before trading news releases."

Archive the weekly notes in a dedicated folder. After a quarter, scan which mandates kept resurfacing. Recurring items point to structural changes you must make outside the chart: sleep routines, pre-market warm-ups, or environment adjustments.

FAQs

- Do I need to log every emotion for every trade?

- Focus on the moments that alter decisions—breaking a rule, chasing, hesitating, or stopping early. Calm trades can be summarized by session to keep journaling efficient.

- How long should cooldowns last?

- Start with 20-minute pauses for rule breaks and full-session stops when tilt appears. Extend durations if you return and repeat the same error.

- What if emotions spike during a winning streak?

- Overconfidence is still an emotion. Apply the protocol, reduce size, and review your risk rules. The goal is to keep wins sustainable, not to press until discipline cracks.

- How do I avoid journaling becoming a distraction?

- Template everything. Use checkboxes, drop-down tags, and short bullet reflections. The system above is designed to take minutes, not hours.

- Can I run this alongside a funded account evaluation?

- Yes—funded traders rely on rule logging to protect trailing drawdowns. Documenting every cooldown gives you evidence if you ever need to appeal a platform decision.

Further Reading

Build a complete discipline stack with these guides:

- TradeTrakR trading journal overview with trading psychology tracking and AI trading journal workflows.

- AI-Powered Trading Journal Analytics — understand how AI surfaces emotional patterns.

- Best trading journal for prop firm traders with emotion tracking for funded accounts.

- Mastering Trading Psychology for Consistent Trades.

- Key Trading Performance Metrics to Track — connect emotions to performance data.

- Automated Trade Tracker — streamline your logging workflow.

- Buy Trading Journal Software.

- How many trades per day do day traders make?

- Trading journal usage and benefits stats.

Explore TradeTrakR

Automate your trading journal and keep psychology accountable with TradeTrakR.

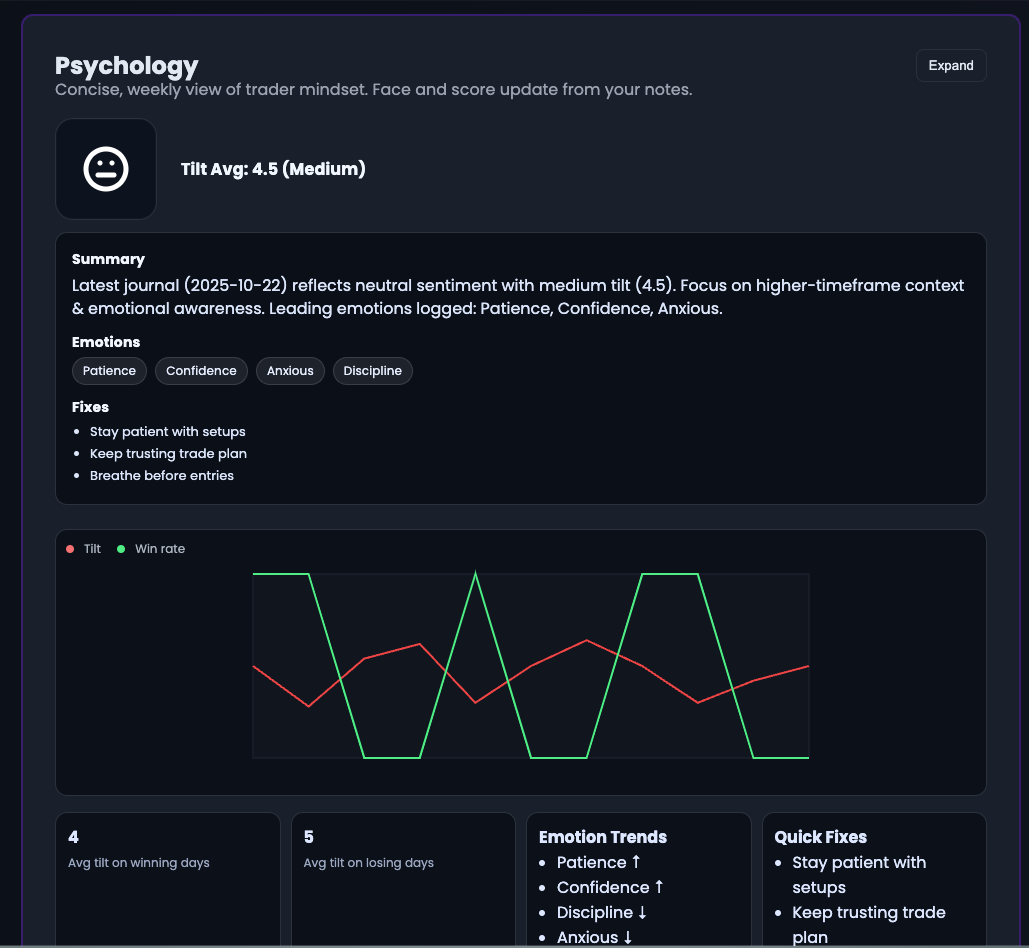

- Psychology & Rule-Adherence Tracking

- AI-Powered Pattern Insights

- Clean, Minimal UX for Focus