Daily Performance Panels

Review session-level P&L, risk metrics, and expectancy. Automatically highlights deviations from plan.

From AI analysis to discipline tracking, every TradeTrakR feature keeps your journal organized, auditable, and actionable—whether you’re funded or trading your own capital.

Monitor performance across accounts, strategies, and sessions. See how your trading log translates to measurable growth.

Review session-level P&L, risk metrics, and expectancy. Automatically highlights deviations from plan.

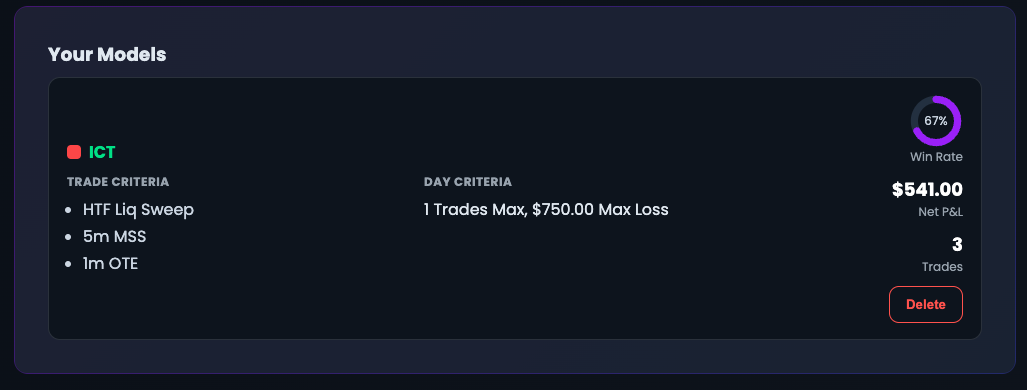

Compare win rate, reward-to-risk, and drawdown for each playbook entry to double down on real edges.

Visualize sizing adjustments, firm limits, and capital efficiency, aligned with daily and weekly targets.

Stay compliant with firm rules while building a consistent routine. These tools also benefit independent traders seeking accountability.

Keep daily/weekly checklists to confirm adherence before and after each session.

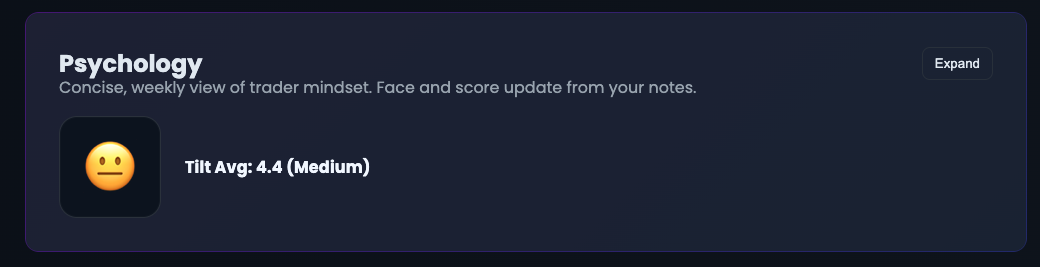

Log mental state, confidence, and tilt; see how mindset influences results over time.

Export concise summaries for coaches or desk managers—share AI highlights with one click.

Keep key metrics, notes, and psychology reminders visible throughout the trading day.

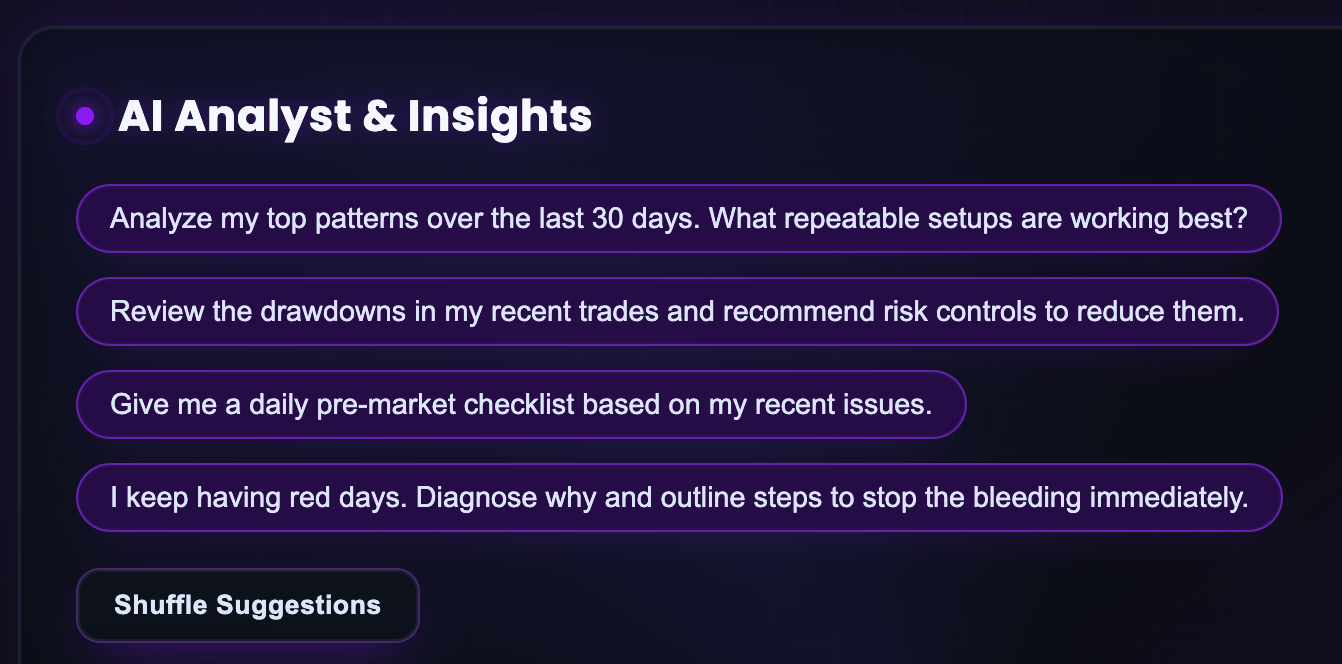

Instant commentary on top setups connected to your journal data—understand what truly moved results.

Monitor emotional drift and see where decisions fell short—keep the psychological game front and center.

Track instrument- and time-of-day performance so your journal guides smarter allocation.

Let AI handle the analysis so you can focus on execution.